24/7 RESTORATION AND ROOFING

Here with you

Tap Any topic To Start Reading

Fractured matting slide

Shingles are made out of tar, which is a petroleum byproduct. Petroleum breaks down from UV rays. Since manufacturers use tar for durability, they know that the shingle must be covered with protective granules, which further increases lifespan.

Long-time exposed tar, as well as punctures, are the leading cause of shingle failure.

In other areas of the country, a roof will last you 30 years because it maintains its granules and nothing punctures them.

(insert shingle diagram that shows composition)

(insert diagram showing hail fracturing Shingle)

FUNCTIONS OF A GRANULE

- Provides color.

- UV protection from UV degradation (wears tar in the street down).

- Wind (holds shingles on the roof from blowing away- missing kills wind warranty.

- Waterproof (protects asphalt).

- Fire retardant (petroleum product flammable).

- Increases the resistance to being able to be punctured. The granules at a tough layer that both protects the tar from the sun and makes them more impact-resistant.

CRACKED MATTING VS NOT

Giant hail comes through the second story and floor and drywall then crashes on the table.

Medium hail dents cars and causes obvious holes

Small hail- cracks membrane which went down as the rain washes granules off the roof. Sun beats up the cracks and they turn into holes.

Tar temporarily re-seals the cracks and prolongs the leak.

WHEN IS THE RIGHT TIME TO REPLACE A ROOF?

The presence of cracked matting indicates the immediate need for a roof replacement.

You have holes in the roof. It’s only waiting time until the water comes in

Water damages the decking and starts to break apart the glue that holds the wood particles together.

When you don’t have cracked matting, you have a little bit of time before you need to replace the roof. It does need to be replaced depending on how deep been removed. You might be able to get away with waiting a few months. You may be able to get away.

But realize that once the sun starts to go down those exposed areas, they are beginning to turn into holes.

I can see underlayment underlayment is rated to last 90 days. After 90 days, the underlayment will begin to fray, lighten, and no longer serve its function.

How insurance totals a roof

6-8 hits in a 10×10 area

(include test square picture grab from sales link)

Hail reduces the lifespan of the roof, to zero if you have cracked matting.

(Insert cracked matting photo)

STIPULATIONS IN WHICH WE DECIDE TO PURSUE A CLAIM OR NOT

One side < 5 hits per square = No file.

One side with 20+ hits per square = Only file in a fresh storm.

Two sides < 5 hits per square = No file unless older than 8 years

Two sides with 10+ hits per side = File any age.

3 sides 5+ per square = File.

Cracked matting anywhere = File.

Without pulling every shingle we can not tell which are broken through, the newer a roof the harder it is to tell which is cracked.

Newer shingles how damage less obviously than older shingles as they have a lot more elasticity in the first 5 years.

More collateral + better chance of approval due to proving the volume of hail

The newer the roof the less likely you are to see cracked matting.

The older the roof the more likely the matting was cracked, due to smaller hail.

WHAT’S COVERED

- Roof.

- Fence.

- Gutters.

- Leak inside.

- Windows.

- Metal.

- Paint around the house.

- Solar detach and reset or cracked panel.

- Other structures.

OTHER ITEMS YOU MAY BE ELIGIBLE FOR

- Step flashing into the siding.

- Paint fascia.

- Ac units.

TIMELINE TO FILE

Insurance gives a small window to file. If you don’t file on the right date and within the window to file they don’t owe for the damage, legally.

Most policies allow 6 -12 months.

1 year to file suit.

1 year to make the repairs (some companies only give 6 months).

Cracked matting/ bruising should be filed right away.

Scuff that did not penetrate the shingle has a longer time frame in which you can wait to file. If you wait outside the 1-year mark most likely you will need to file a lawsuit to be able to claim the damage.

Some areas don’t get much hail and we file on those ASAP because as a roof gets older your chance of getting the roof lowers.

Insurance companies do not buy roofs because they are old, they must have storm damage. Rates also go up the older your roof gets because they know it will inevitably will need to be replaced.

If you managed 5 billion in policy funds, would you want to give out an extra 20-40k?

HOW THE PROCESS WORKS

- Adjustment – Meet with the contractor of choice

- Approval – Discuss price and scope (nothing is final at this time) They make an initial settlement offer.

- The scope comes back – We sit down and explain what all is approved and discuss missing items that you are eligible for (cost incurred)

Make a plan for what you want done and execute. Go over what you’re eligible for, and make sure you understand every item - Then you pick a color, we build your roof.

- Supplement any missing or incurred items.

- Final invoice to release depreciation.

*If the mortgage company is listed as an additional payee then you will need to have your loan verified and the check stamped

A roof is installed in one day.

- Gutters are scheduled after the roof is completed and installed in one day.

- Window screens take 1-2 weeks to be installed.

- The fence stain is scheduled according to the installer’s availability and is completed in 2-3 days.

- If your home needs to be repainted then that takes 2-4 days.

WHAT ARE YOU ELIGIBLE FOR

- Roof.

- Gutters.

- Fence stain.

- Painted surfaces that are chipped by hail.

- Ac equipment damaged by hail.

- Any person’s property that is broken or damaged by hail.

- Any Items that are directly affected by hail.

Main Dwelling – Items connected to items that are affected: siding, fascia, stucco, patios, or anything bolted to the home.

Personal Property – Anything that moves when you move like lawn chairs, umbrellas, to other furniture.

Other Structures – Detached sheds, fences, and any other items that do not have to be bleed to the home. Some policies have limits on these items.

Harder To Buy Items – Ac units, repainting all siding and fascia not damaged by direct physical contact with hail.

FILING A CLAIM

(WHAT I NEED TO REPORT TO MY INSURANCE COMPANY)

- Date of loss.

- Items damaged.

- Cost incurred – They make us prove what’s missing. The work must be done to incur the cost.

- Approximate damages and price if available to set the cap on the claim.

NEXT STEP

Select your contractor and have them present at the time of inspection to walk through all damages.

We meet the insurance with our bid. We will include every single reasonable item you are owed and/or want! We will present to the adjuster to get coverage extended.

SUPPLEMENT

Sometimes the adjuster needs you to incur the cost first or does not agree with covering an item, we can discuss the next steps for getting it approved. Most times after we send in pictures and explain, the item gets covered.

The insurance owes the proper amount of what the work would cost. Often they are low on what the cost would be because they know some people take credits instead of getting all of the work done. they hope that you will because it saves them hundreds of thousands per year. Even if you are not doing the work, we insure the insurance pays the fair market value for the items damaged, as a courtesy to you.

We will present legitimate damage to the insurance company for every dollar that they should pay for all of the items damaged. Insurance claims are settlements, they often try to settle for as low as possible. the insurance covers the main items like the roof/ gutters/ fence and then skimps on pricing for shutters, window screens, AC repairs, and any other item that can not be accurately estimated by the square foot.

*Any unforeseen cost or one that needs to be incurred- cost incurred shown by pictures of it being done.

DEDUCTIBLE

Once the “fair market value” is determined then your deductible is subtracted from that amount and a check is issued. The deductible is the part that the homeowner is supposed to pay to make the claim amount enough to make all of the repairs.

If you have a $30k claim and your deductible is $5k then the insurance will write for $30k in damages and give you about $15k upfront but then subtract the $5k deductible off the ACV. Then you can recover the remaining $10k at the end.

Some people choose to. Do not make repairs to the fence/ gutters/ windows, etc., and use the money towards the deductible. Others prefer to have the whole property restored completely. When the homeowner pays the deductible in full we can complete all repairs promptly!

WE GUARANTEE THAT YOUR ONLY OUT-OF-POCKET IS YOUR DEDUCTIBLE PLUS ANY UPGRADES YOU MAY ELECT TO ADD ON.

What Does The Insurance Owe For

- The reasonable cost incurred.

- Replacement cost or whatever the policy covers.

- Consequential damage, or damage caused through the natural cause of construction.

Prepping for the adjuster

For the fence, gutters, and all collaterals you must know the approximate age of each. Sometimes we need to prove why the damage to the roof is hail. If we dont have sufficient damage to the collateral then it can be difficult to get the claim approved.

Denials

- New roofs sometimes get sloped so we are careful when we call for replacement.

- Old roofs are generally disco or brittle, which helps the cause.

- Disco + No repairable = A Win For 24-7 Restoration.

- Dented metal and how they tie in with the roof.

Click To Explore Bonus Content

DEDUCTIBLE

HOW WE HANDLE DEDUCTIBLE

- Credits.

- You are legally allowed to take the money from items like fences, gutters, screens, garage doors, etc., and apply it to the deductible.

- 3 types.

- Making money appear vs disappear.

- What if we don’t replace something?

DEDUCTIBLE

- Fastest and easiest. You pay deductible and we have minimal supplements, we fight less

- Crediting collateral

- Appraisal.

Timeline

- Roof on in one day 6 am-5 pm.

- If taken deductible 2-3 weeks.

- If we have to fight for more money, then collateral gets done when a final check Is on the way.

- Solar, panels off the week before. Back on the week after. Send your electricity bill to the adjuster.

- Come back the next day to clean up your nails again

If you can not afford the deductible then we do have an alternative route which is where we add as many charges onto the estimate as possible and then get the insurance to cover as much as they will. we kick the rest to appraisal and once the appraisal is completed then we take the funds for the roof and use the remaining funds to cover repairs to as many of the remains items as we have funds to complete.

Worst case scenario we can get enough to do the roof so you don’t have to pay out of pocket. Best case scenario we get them to cover everything and then do all the work once it’s paid for.

You’re out of pocket expense is whatever your deductible is. Once that threshold has been met, the insurance company owes to pay for everything else. But you have to prove to them what they owe and why. They have created deep guidelines over what they will pay for and what it takes to qualify, so they’re not just walking around handing money out. A person who’s good at my job knows how to follow the guidelines and find things that fall within them to benefit you.

2% deductible – The agent writes your policy, they dont see storms. Claims don’t change your policy, they see storms. Typically if you change your deductible to 1% and file 90 days later the record of the change is gone out of the system.

BONUS TIP

An appraisal is when the insurance company does not pay the fair market value or we disagree on an item being covered. Neutral third parties are hired by each side and the items that have validity to them are agreed upon and an amount is reached that covers all costs incurred. Appraisal works in almost all cases, especially when an adjuster is not willing to budge.

How we build a roof that lasts a long time

MOST PRONE AREAS TO LEAK:

- Valleys.

- Pipes.

- Ridge.

- Penetrations.

- Flashings.

We can install ice and water over these areas to prevent future leaks.

We lap the underlayment over ridges to give an additional layer of protection.

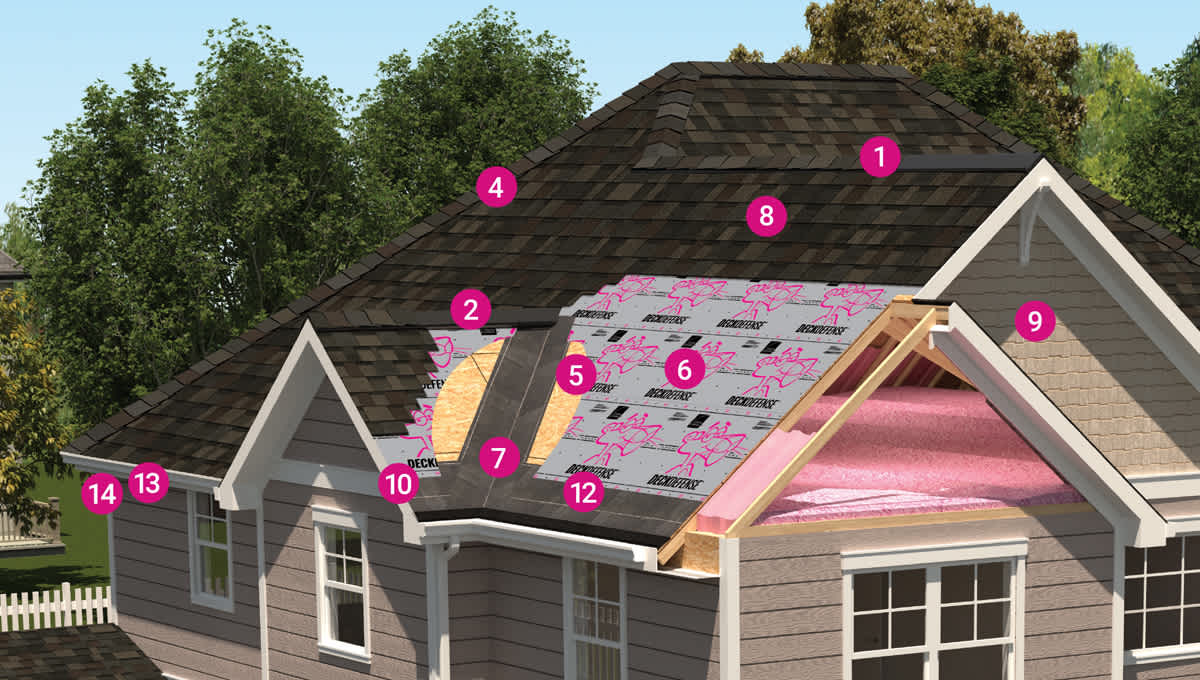

RE-ROOFING PROCESS

- Ice and water.

- Differences in shingle types.

- Synthetic underlayment versus regular.

- Differences in warranty.

- Wrapping the penetrations and ice and water.

- Eligibility with Siding being painted.

- Metal vents versus plastic.

- Metal goose necks.

- When increased ventilation is required.

- Tearing off to the decking.

- Inspecting the deck.

- Replacing decking as needed.

- Protecting the property.

- How to deal with Supplements.

EXPECTATIONS

- Cover up to 3 sheets of decking.

- Metal vs plastic vents (insert pics)

- Paint it all to match.

- Property protection.

- Fence before and after.

- Warranty; what’s included vs excluded.

- Ice and water.

- Full tear-off.

- Cover all penetrations.

Comparison chart

Lowest Builder Quality

GAF Tamco

Middle-Grade 30-Year

- Owens Corning Atlas.

- Malarkey Certainteed (basic series).

- Certainty landmark.

High-Grade 30-Year

- Owens Corning Atlas.

- Malarkey Certainteed (basic series).

- Certainty landmark.

- Certainty landmark pro.

- Duration, Pabco, Atlas Vista, Certainteed landmark.

Impact Resistant

- Compare brands and tear strengths

ROOF COVERINGS AND PRICE RANGES ARE BASED ON DECK CONDITIONS, UNDERLAYMENT, COLOR, AND STEEPNESS

- Standing seam (800-1200).

- Mechanical attract metal (850-1150).

- Concrete tile (1200-1500).

- Brava (1800-2600).

- Euro shield (900-1350).

- Stone-coated tile (900-1300).

- F wave (750-1000).

- Da Vinci (1400-1600).

(insert photos of the following and a general price range)

WHO IS YOUR INSURANCE ?

GENERAL INSURANCE GUIDELINES

Allstate – Staff adjusters hate to pay for roofs. Often they try to give repairs. Especially if Roof is under 10 years old. Allstate also likes to pay out as little as possible upfront.

State Farm – Just provide good coverage as long as you claim the damage within one year. If you do not claim the damage within one year, they will fight you to the death to pay for it. Bad about trying to use a material supply warehouse to lower the amount that they pay.

USAA – A great company with great coverage. Very easy-going on making sure that all the proper amounts have been approved. Their only downfall is that sometimes they have cosmetic exclusions and sometimes they have 2% deductibles.

Nation General – A decent company. Does not like to pay a lot. Smaller company with no actual staff adjusters in Texas.

Geico – They have a couple of subsidiaries. Decent on coverage. Very low on the price they want to pay.

Travelers – Good company as far as coverage goes. Are more people-oriented than they let on. If the homeowner wants it, most of them will cover it.

Farmers – Got rid of their next-generation policy, which was good coverage with a one percent deductible. They lowered coverage and increased the deductible amount to 1.5%. Harder to get a roof bought with them than it was in previous years.

Branch insurance – A good company pays a fair price as long as the deductibles are collected.

Amica – Good coverage. Uses independent adjusters. Has a lot of non-recoverable issues like fences and roofs.

TYPES OF ADJUSTERS

The first adjusters that come out after a storm are the Catastrophe Adjusters. Their job is to get the brunt of the work done. they know the storm well and often adjust 10-50 homes in a neighborhood. they know that hail can cause irregular damage and they are more cooperative

Staff Adjusters oversee the claim but they trust the word on a tenured adjuster with many years of experience. Staff adjusters are usually greener and have less experience. The Staff Adjusters typically don’t climb roofs and have more book knowledge than first-hand experience. Either way, the staff adjuster’s job is to mitigate the amount of money the insurance company has to spend.

The later in a storm that you file the less likely the carrier is to want to keep paying out. The staff Adjusters also don’t know the neighborhoods like the Field Adjusters and are very particular about what they consider “textbook hail”.

it’s best to file sooner, even if you want to wait to replace the roof. your contractor can help make sure they paid the correct amount, barring any supplements or cost-incurred items.

THE DECISION IS UP TO YOU.

TYPES OF ADJUSTERS

Desk – Owns the claim

Cat – Most likely to buy.

Staff – Dont like to pay.

Independent – They work for themselves.

Public – They work for you.

Appraiser – Neutral third party.

Lawyer – Won’t take a case unless they feel its worth their time.

Policy Audit

ACV – The actual cash value of the item. this is the way that a car is paid for. It’s basically the life span that’s left in which the item being replaced should have lasted if it was not damaged by hail.

Roof Schedule – Your roof is depreciated according to how old it is. The older it is the less the insurance pays. It works just like ACV.

Exclusion Page – This is the page in your insurance that spells out clearly what is and isn’t covered. If it’s not excluded then it’s included.

Marred Metals – This means unless your metals have physical holes punctured through thyme then the insurance doesn’t owe coverage. Gutters would be covered if they did not function due to being torn from the building.

The Fence Is ACV – Some policies are actual cash value on the fence only.

Your Responsibilities After A Loss – This section will tell you what your insurance wants you to do after a loss.

WHY US

- Were the best.

- We stand behind exactly what we promise to you that we will get done.

- Transparency – We break everything down so you can make the best decision for your home.

- Good oversight of the job.

- Top quality work.

- Best warranty 20-year labor warranty.

- We use the same subcontractor that we have used for over 7 years. We pick out the best.

- Property protection.

- 3 x nail clean up.

- Our warranty is in your favor, we want to provide top-quality installation.

- Closed thing to a Texas license which is Rcat.

- We hold insurance with umbrellas to cover them.

- We have used the same crew for the last 7 years.

- Our crew has full insurance, and we have extended coverage for them as well.

- Property protection photos.

- We teach you how the process goes.

- Ice and water, shingle quality, and warranty.

- What’s excluded from the warranty?

- Cover 3 sheets of decking at no extra charge.

- We go after the result you want whether it is a quick turnaround or additional. cost, or even just the ease of not having to coordinate the job yourself.

- RCAT & Insurance.

Our warranty goes off the components installed. If all of the quality parts are in place then we offer a 20-year labor warranty. We use a mix of the best components to ensure the highest quality roof.

All components provide a roof with a very low likelihood of leaking. If for any reason excluding strong winds, over 70MPH, or damaging hail pierces the roof again, we will cover the cost of the repair to the roofing assembly.

For an additional cost, you may purchase interior protection against drywall, mold, and even flooring.

VIEW RCAT LICENSED ROOFING CONTRACTOR DOCUMENT

VIEW CERTIFICATE OF LIABILITY INSURANCE

VIEW OUR 20 YEARS WARRANTY CERTIFICATE

FAQ

How do rates go up?

(Insert Answer Here )

Does this affect?

(Insert Answer Here)

End of the storm season?

(Insert Answer Here)

How long does each trade take?

(Insert Answer Here)